Peter Brandt, an expert investor with half a century of experience in the market, recently reiterated his bearish prediction on XRP compared to Bitcoin.

In a post on the social network, Brandt shared a chart illustrating the XRP/BTC price ratio on weekly candles, highlighting a bearish trend over the years, which has become more pronounced in recent months.

According to Brandt, this pattern suggests that XRP could continue to devalue against Bitcoin, even approaching a zero value.

The chart shows that the value of XRP against Bitcoin has gone from 0.00001457 in January to 0.00000808 currently, a reduction of more than 44%. This drop in its valuation is compared to a 43% increase in the value of Bitcoin in the same period, evidencing a clearly inferior performance on the part of XRP.

Reactions to Brandt’s predictions

These claims have not been received well by the XRP community, with some mentioning that Brandt’s predictions have not always come true. A clear example was on November 26, 2017, when after his predictions, XRP increased by 1,418% to reach an all-time high of $3.84 in less than two months.

Despite the criticism, Brandt remained firm in his position, specifying that his bearish forecast is exclusively comparing it to Bitcoin and not its dollar value. Furthermore, he noted that in the last 126 months, XRP has only closed above current levels on 6 occasions, calling into question the optimism of investors who still support the coin.

Movements of large amounts of XRP

Perhaps this doubt was raised by an XRP whale, which recently moved 30 million XRP tokens to an exchange, a move that has possibly increased selling pressure on the cryptocurrency.

Still, at the time of writing, the price of XRP is $0,5060, showing a slight increase of 1.36% in the last 24 hours.

The important thing is that it has recovered the support of 0.50, since it lost it over the weekend, showing signs of continuing its decline.

At the same time, the Relative Strength Index (RSI) for XRP/USDT is also showing a bearish trend, with a current reading of 37.63, indicating possible oversold.

SEC vs. Ripple

However, the outcome of the XRP price will depend on the SEC’s final decision on the legal case against Ripple.

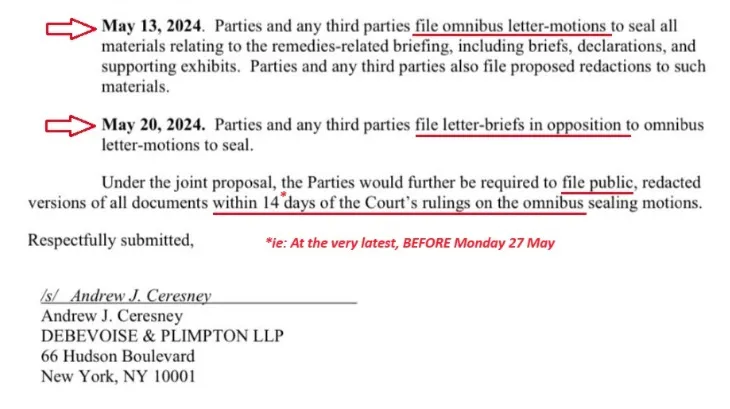

Upcoming motions are expected in the case, including “omnibus letter motions,” which will be critical in determining whether Ripple will face large penalties for the sale of unregistered securities.

The court’s decisions regarding fines and possible SEC appeals could have a profound consequence on the pricing and perception of XRP in financial markets. The next date to watch in this litigation is May 20, when the court is expected to issue a ruling on the sanctions.

Final words on XRP

Although XRP’s bearish technical prediction may be supported by technical analyses, the pending legal determination between Ripple and the SEC will likely be the most influential factor in the short- and medium-term fate of XRP.