Protecting any Internet service account is fundamental. You must always use strong passwords, activate the two steps authentication method and make sure your device is protected. However, we sometimes make a mistake and we can put our bank account in danger or a social network service. This article is about a common mistake when you try to protect your bank account. If you want to avoid common issues, take note of this.

The most common bank account mistake when protecting the online access is referred to your card PIN. If the password you use is not appropriate, the hackers may steal your data more easily. It’s even possible for them to steal your account data if there’s a leak of information.

The card PIN and the most common mistake with an online bank account

It’s a very common mistake to use the same PIN code for every card. It’s true, using just one PIN comes in handy, but it’s not secure. You can easily memorize it but all your cards are exposed if the PIN leaks. In the security sector, it’s called the Domino Effect. It means that you have different cards but the PIN gets stolen and all of them are vulnerable at the same time.

Imagine you make a purchase in a fraudulent website and introduce the PIN for your card. If you have a separate PIN for each card, then you will only need to change the one affected. But when you share the same PIN with all your cards, all your financial services are exposed.

You can obtain a new card if you lose the PIN, but all the others will also have to be changed. It’s a pretty common risk that you can avoid. The only thing you need is to choose different PINs and write them down so you won’t need to memorize them all.

How to protect your bank account and prevent a mistake

In order to choose a secure PIN for your card, you should use a totally random one. It’s important not to repeat it in any other service. It’s also important to generate a PIN with no relation to dates or important personal numbers. That’s the most efficient way to protect your accounts. The main objective is to make it difficult for hackers to connect your card with a PIN.

Another good security measure is to change the PIN code frequently. This guarantees that the hackers won’t be able to access your bank account that easily. If you periodically change the PIN and make sure your passwords are updated, you add security to your Internet experience.

A good PIN is also effective to grant you a good bank account experience online. If you have a strong PIN your bank app will be protected. It’s also important to have an antivirus running and avoid shortened links.

Add more protection to your account

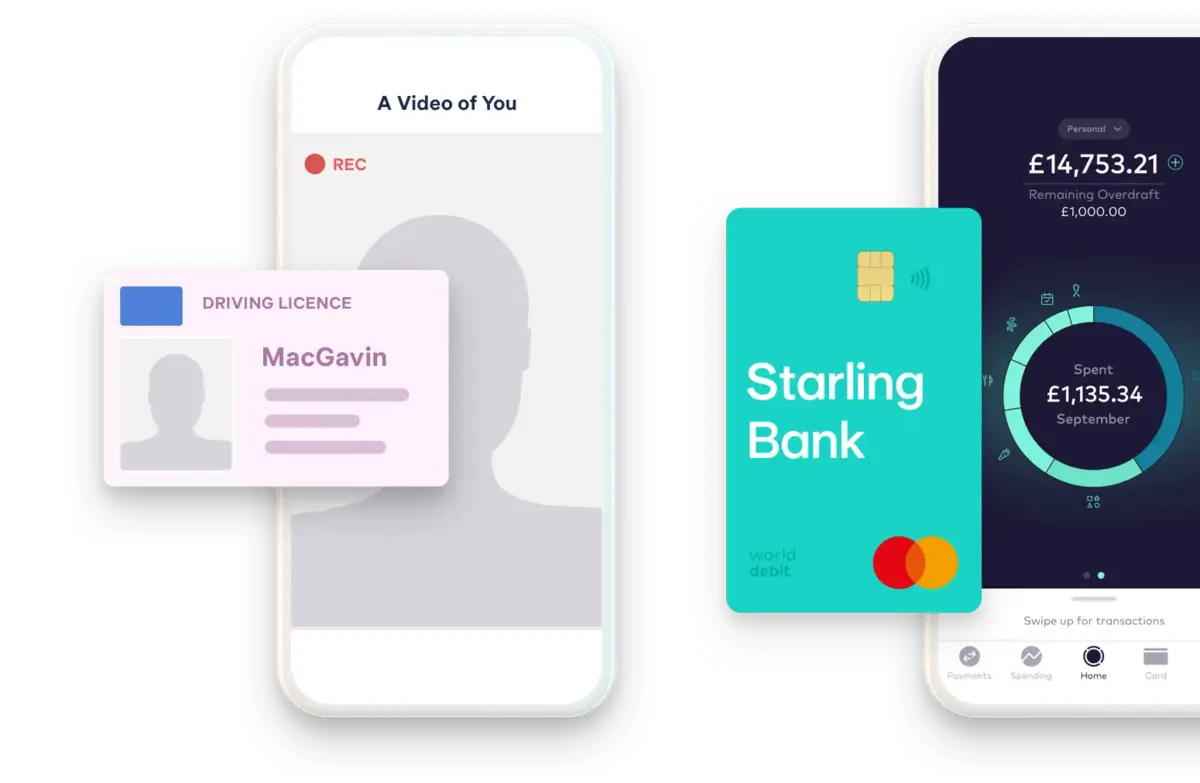

On the other hand, you can always introduce extra security in your bank account and avoid a mistake. Protect your card and enable the two steps authentication method. It’s a great tool because you will pay and confirm your identity before sending the money. If a hacker wants to make an operation, you will detect that your PIN has been stolen.

Also make sure your cards have a limit for withdrawal or payments. Through these alternatives you can reduce risks in case your card is stolen or duplicated. Finally, you can opt for freezing the card if you suspect the PIN has been compromised. You could freeze the card temporarily if you don’t use it very frequently. It’s another way to avoid mistakes and fraudulent buys.