Chainlink has announced the addition of two new features that strengthen the privacy preservation of blockchain transactions, along with an update to an existing capability.

With these improvements, financial institutions maintain the integrity of their data and remain compliant, even when transacting across multiple blockchains.

Privacy in Systems Integration

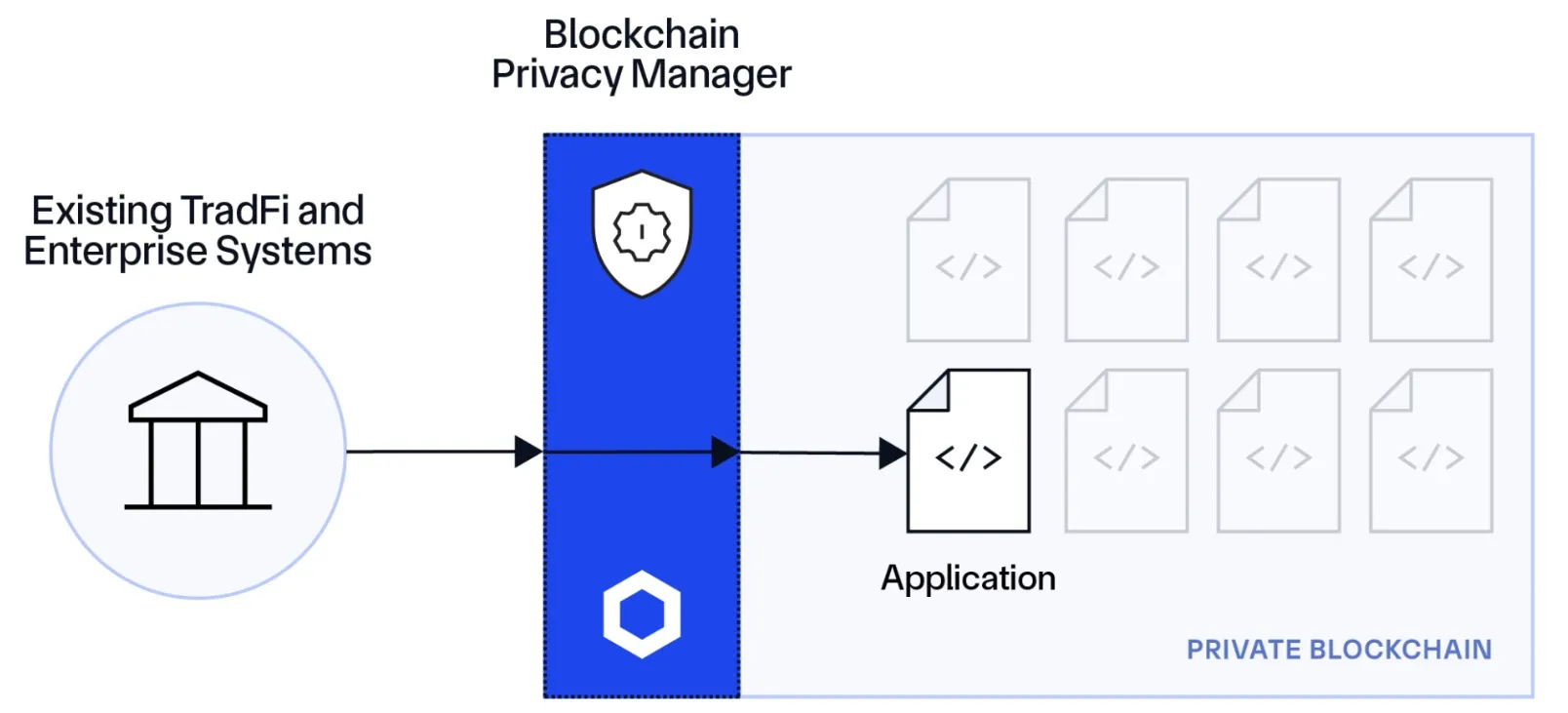

The first new feature is the Blockchain Privacy Manager, a tool that allows financial institutions to integrate their private blockchain networks with existing systems, such as enterprise backends, without compromising data confidentiality.

Additionally, these private networks can connect to Chainlink’s public network to access external data such as market prices, Net Asset Value (NAV), Proof of Reserve (PoR), and identity verification.

The tool gives institutions full control over what data to share and what to keep private, complying with data protection regulations.

Private Transactions with CCIP

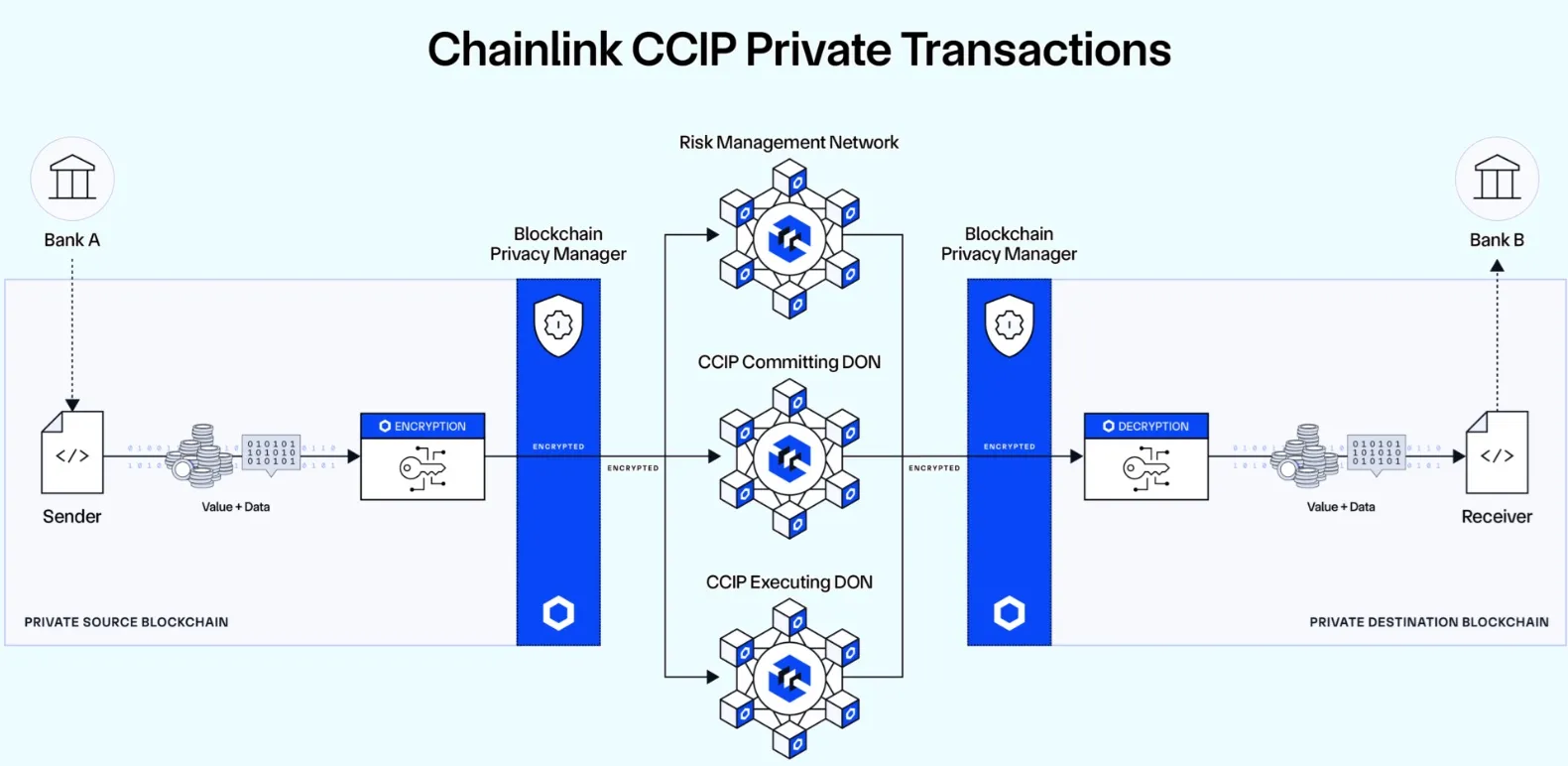

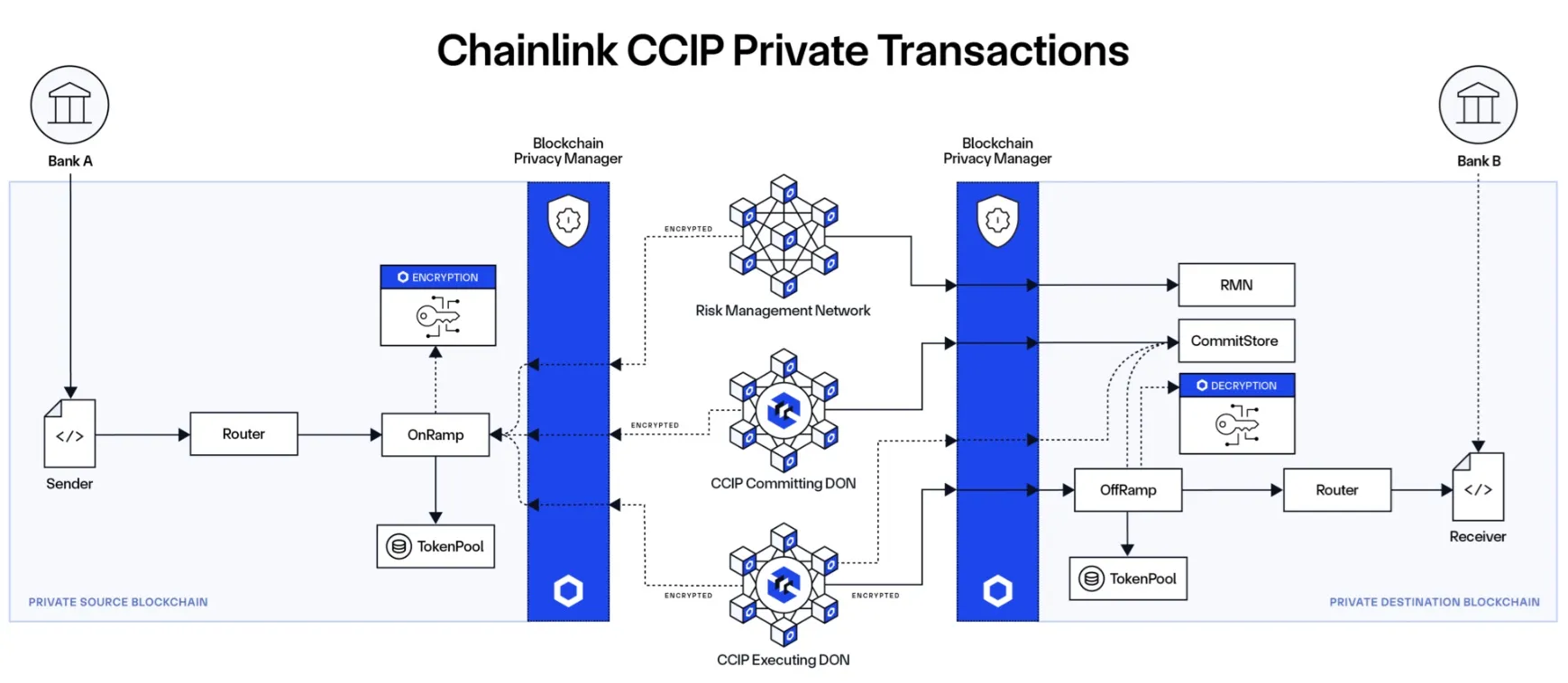

Another new feature is the ability to conduct private transactions through the Cross-Chain Interoperability Protocol (CCIP) network.

This system is based on an on-chain encryption/decryption protocol, which allows institutions to transfer assets and data between different blockchains in a secure and confidential manner.

End-to-end encryption ensures that sensitive data, such as the amount of tokens, the addresses of senders or receivers, and any other data instructions, remain hidden throughout the process.

The most interesting thing about this system is that the encryption keys are generated and controlled by the institutions that use them. These keys can only be shared with the parties that the institutions choose, such as auditors or regulators, allowing selective control of the information.

DECO technology for the verification of private data

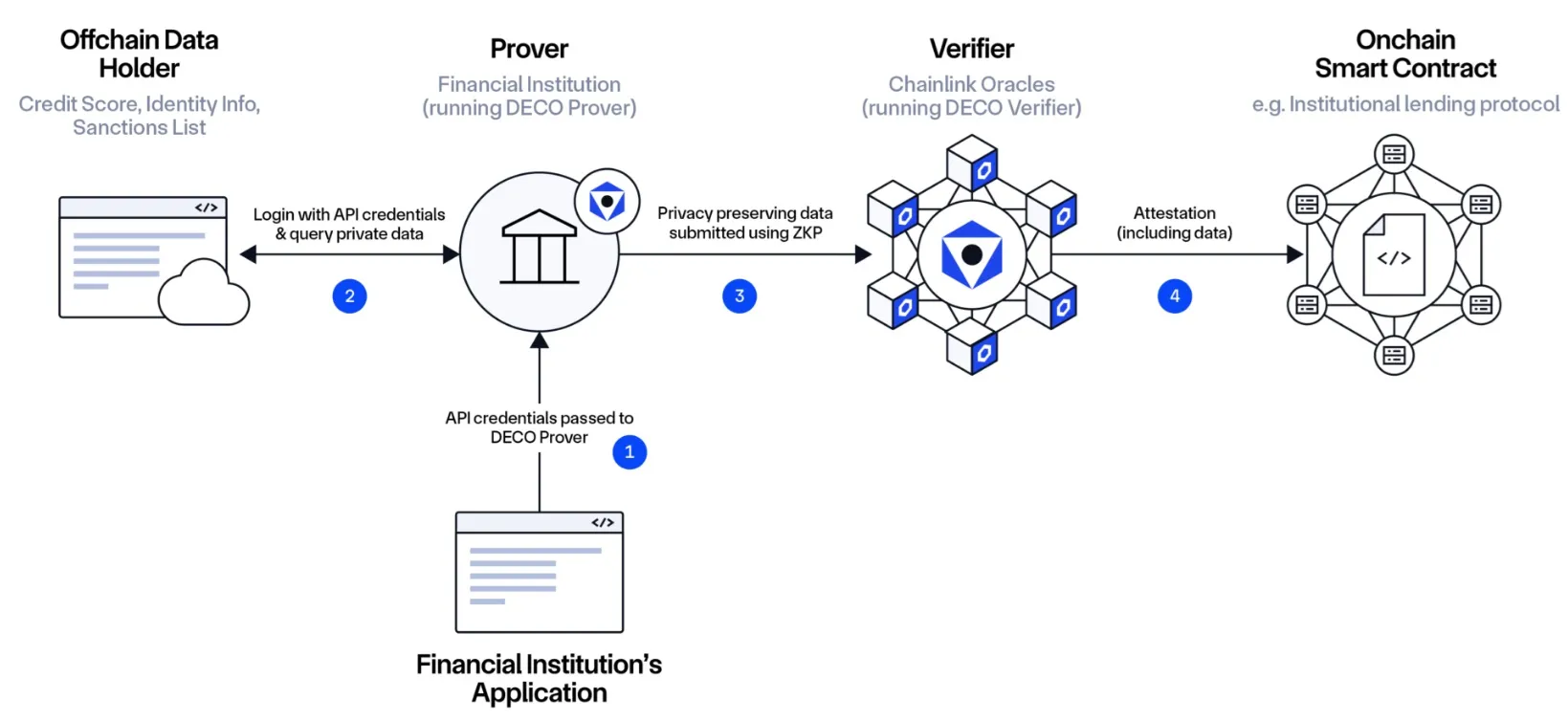

At the same time, Chainlink has updated its DECO technology, which uses zero-knowledge proofs (ZKP) to authenticate data without exposing sensitive information.

DECO is particularly useful for verifying identity, funds, or complying with regulations without compromising user privacy.

The upcoming release of the DECO Sandbox will make this technology available to the public, providing pre-configured use cases that demonstrate how to preserve privacy in complex environments.

Why?

As financial institutions adopt blockchain solutions to process tokenized assets, there is an increased demand for interoperability and privacy between public and private networks.

According to estimates, the tokenized asset market could reach $16 trillion by 2030, and institutions are already moving from simple proofs of concept to real implementations in areas such as international payments and securities settlement.

However, this growth requires the protection of data privacy during cross-chain transactions, as required by regulations such as the General Data Protection Regulation (GDPR) or the Markets in Financial Instruments Directive II (MiFID II).

And this is where Chainlink solutions come in, addressing these obligations, allowing institutions to conduct private, secure transactions that comply with regulatory requirements. In addition, its cross-chain interoperability makes it easier to connect and operate between different blockchain networks without having to build expensive and complex infrastructure.