The USA presidential election is coming. In November Donald Trump and Kamala Harris will face each other with a growing public deficit as the background for the campaign. The republicans will look for instances to eliminate taxes and democrats want to increase expenses over the price levels.

Joe Biden successor Kamal Harris said publicly that she wants to enhance the bidenomics. This includes an expansive budget with higher taxes for those who earn more, companies and latent capital gains. The focus of Kamala Harris campaing is put on inflation, housing crisis and weakness of international demands for American products. The female candidate has a Keynesian approach, most of all when talking about cpital issues.

Higher tax for companies and millionaires according to Kamala Harris

The main step in Kamala Harris program is increasing marginal types of capital gains and work gains taxes. The new taxes will be of 44,6%. A notorious increase for capital gains on millenaries to help middle class through investment on public services and job creation.

Harris’ state intervention plan focuses on Biden idea of taxing higher classes. Those who have more than 100 millions will have to pay capital gains. That way the accumulation of wealth per se will be discouraged.

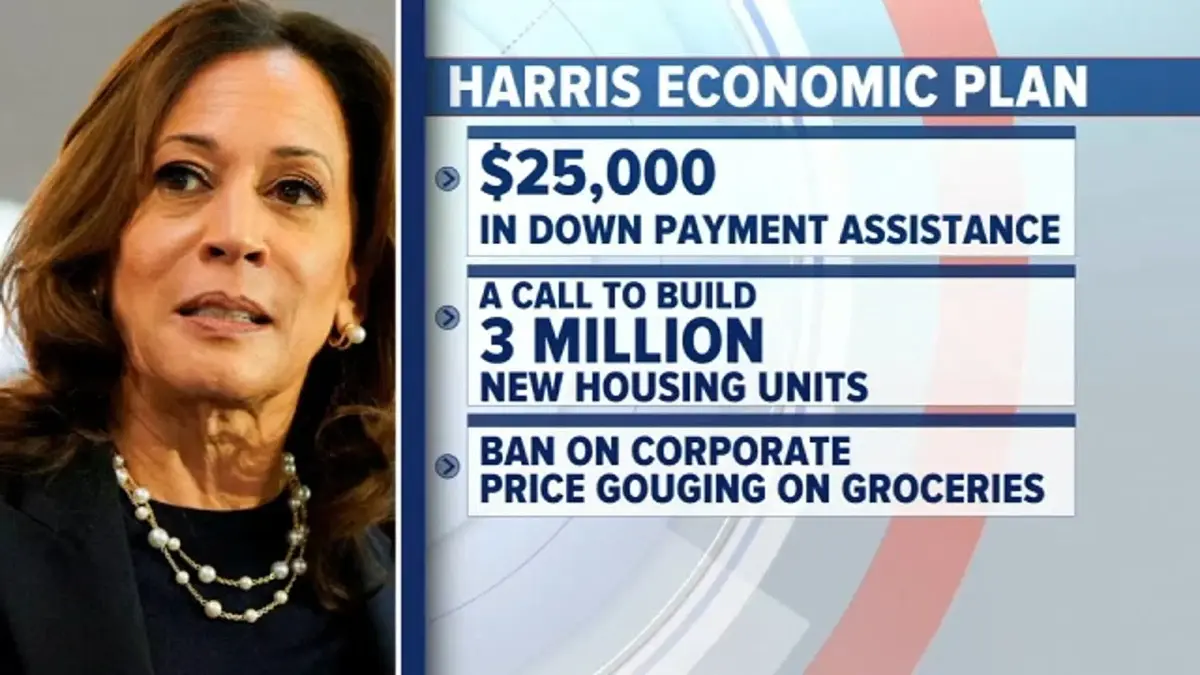

The democrat candidate also wants to reduce basic food price and fighting inflation directly. Monopolization is another enemy of the democrats program. Kamala financial program will get money from companies’ taxes. They expect collecting more than 1,3 trillion in ten years. The corporation taxes will rise from 21% to 28% and they should pay at least 15% of the reported income. There’s also an attempt to rise from 1% to 4% the stock buyback of companies.

The society taxes rise to 28% is a fiscally responsible step to return money to the working people. It’s also a good tool to guarantee that millionaires pay what they should.

If Trump wins, he will cut off taxes to companies even more. Kamala Harris economic plan reverts most of the legislation that Trump signed in 2017. For example, he reduced societies taxes from 35% to 21%.

Direct consequences of Kamala Harris promises

There are those who think that Harris’ plan will suffocate American economy. It’s the door for a negative buckle that will hurt those who invest in national territory. However, an economic calamity is far from happening. The affected ones are just 0,01% of the richest people of USA.

If the new capital gains tax is on, if the stock price rises and they are not sold, the State will earn a fixed percentage of the gains. The controversy is on. Some of Harris’ campaign donors are already angry. For example, Wall Street and Silicon Valley executives are trying to change the democrat agenda. Tax Foundation indicates that Biden-Harris coalition in 2020 promoted different tax rises.

Help to middle class families

Harris plans to give 25.000 thousand dollars loans to middle class citizens. They would be able to use the money to buy a new house and there will be a 40.000 million fund.

There will also be a limit of 2.000 dollars for extra expenses on medicines uncovered by medical insurance. The family loans during the first year of the new baby will still be of 6.000 dollars.